Clara’s Answer

The member-first model of consolidation

Clara is a purpose-built pension scheme and a purpose-built company. We have a single, clear focus: protecting the interests of and delivering results for our members.

How does it work?

Consolidation isn’t a new idea: discussion over the best approach to securing buyout for defined benefit pensions has been ongoing for more than a decade. Since the Government outlined their approach to the future of defined benefit pensions in 2017 and 2018, a number of solutions have been put forward to address this issue, including consolidation.

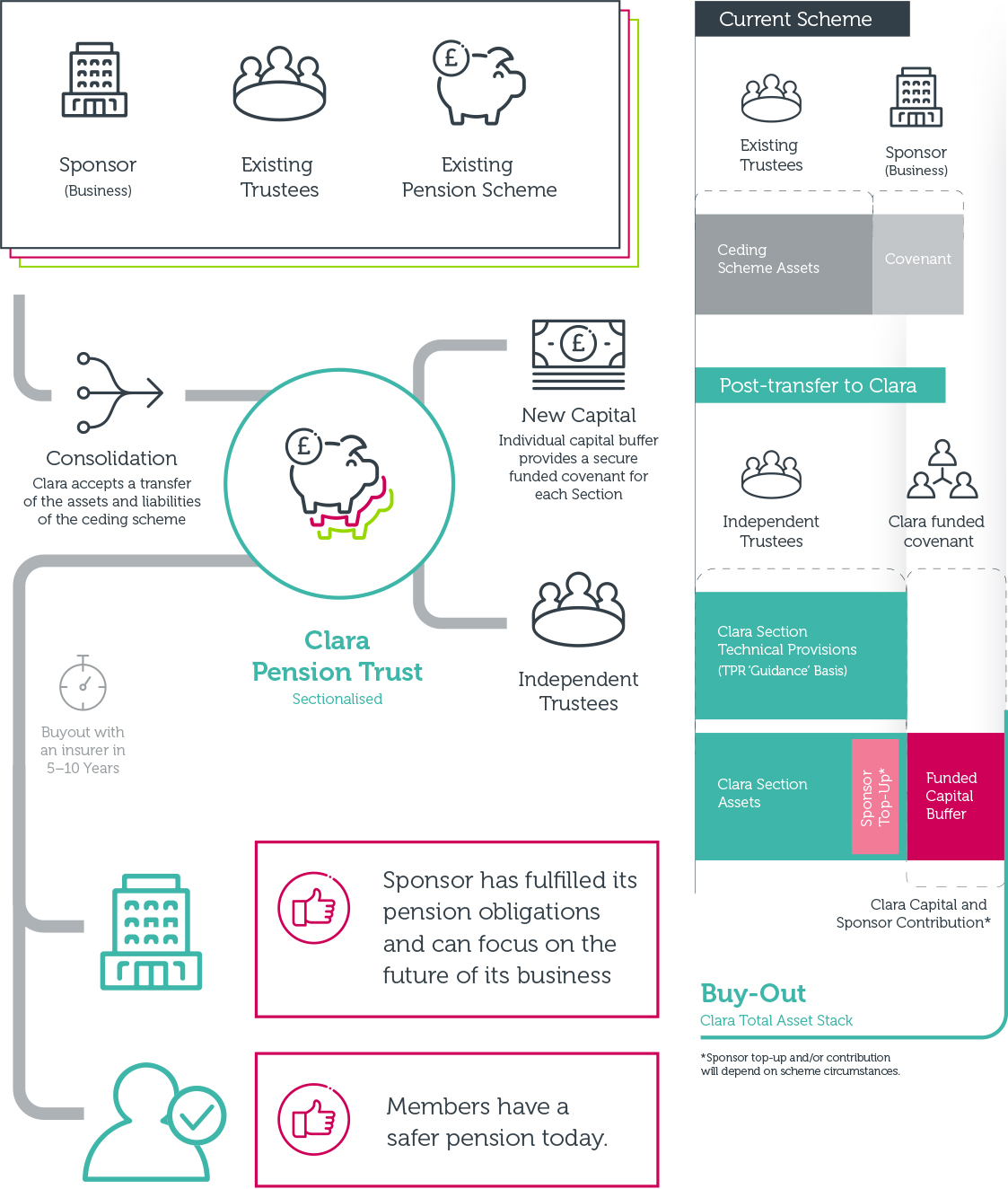

Within consolidation, there are different approaches such as combining scheme support, or bringing together investment options. While these approaches can help many schemes, as part of their model they retain the link to the existing employer with all of the risks and obligations that come with that. So we took a different route:

Clara brings together schemes, replacing existing sponsors to give greater security to members on a lower-risk journey to buyout.

This approach allows us to offer:

• Greater security for members

• A shorter, lower risk journey to buyout

• Fulfilment of sponsor / employer obligation

• A new risk transfer solution — deliverable today

Clara’s model of consolidation is known as a “superfund” which is overseen by The Pensions Regulator. Once a trustee (working with any sponsor) has decided to transfer their pension scheme assets and liabilities to Clara, the employer covenant is removed and replaced by the security of funded capital buffer — this is funded by our capital providers and may be supported by a lump sum contribution from the outgoing sponsor.

Over time, this one-off payment is often lower than the costs of running the scheme in-house and with much lower risk to the business.