Clara’s member-first model

Our model is centred around putting members first.

By taking this approach, every decision we take as a business is aligned to our mission of ensuring a more secure journey to buyout for members.

What happens when you transfer to Clara

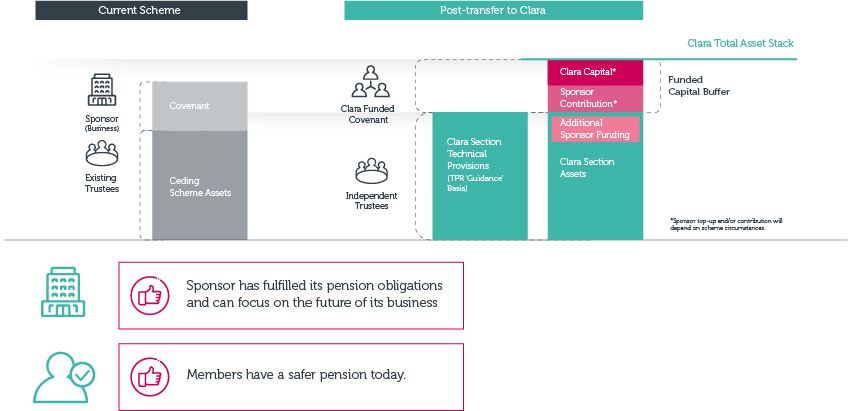

Assets and liabilities transferred from a scheme to us become a new section of the Clara Pension Trust. A well-funded capital buffer stands behind each section. This buffer is funded by a mix of Clara capital and a one-off payment from the outgoing sponsor (in most cases).

We then work towards buyout of the section in, typically five to ten years (similar to the journey that many other pension schemes will already be on). Only once member benefits have been fully secured or provided for do any excess assets in the section contribute to return on Clara’s capital.

Key features of our model

Covenant replacement: We replace a traditional sponsor covenant with a well-funded capital buffer from Day 1. This buffer is funded by our capital providers, and where required a one-off contribution from the out-going sponsor.

Member security and full benefits: Our funded covenant, prudent and appropriate investment approach and focus on securing buyout helps us secure members their promised pensions.

Aligned interests: Clara cannot access the excess assets of a section until every member in that section has their full benefits secured or provided for. This ensures that interests are aligned and that members remain at the heart of what we do.

Sectionalisation: Each incoming scheme’s assets and liabilities and supporting capital buffer are part of the Clara pension scheme but set apart from each other. This gives clarity to ceding trustees and sponsors, while the benefits of scale gives greater security for members.

For more information about our model or to help you decide if Clara’s model of pension consolidation is right for you, please get in touch.